A Basic Guide for How to Calculate Commissions

However, for those simpler plans with only a handful of payees and straightforward commission rates, we’ve outlined a basic guide for how to manage your commissions with confidence. In the end, a solid commission structure, a commission calculator, a winning sales strategy, and your motivation to succeed can add up to an extremely lucrative career. Put in the work, make those sales, and watch your commission checks grow. Once you have your sales numbers and commission rate in hand, you can now calculate your total commission earned. A commission is a payment or compensation you receive on behalf of a company or client for making a successful sale. It is a percentage of the sales price that goes directly into your pocket.

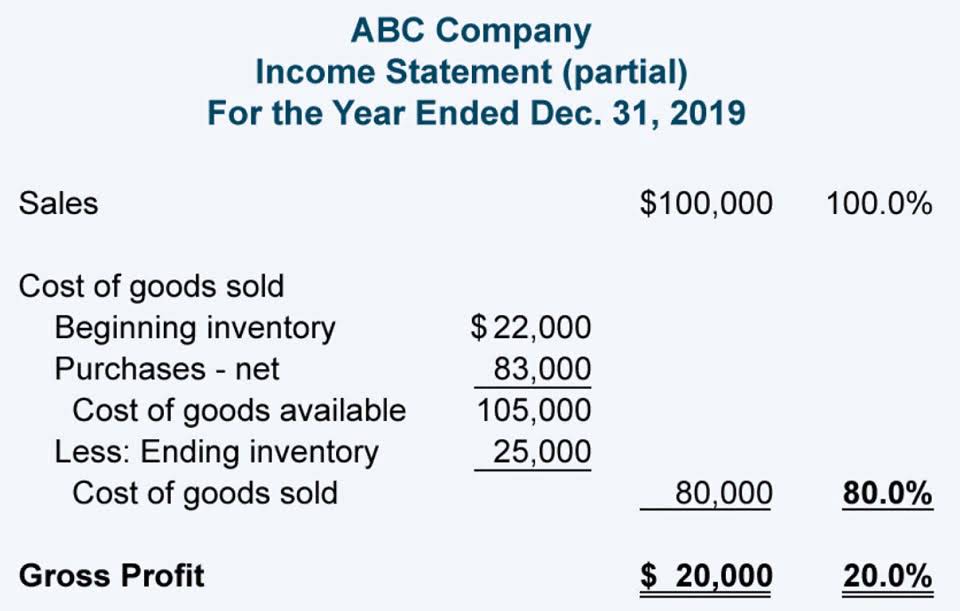

Example of Profit Margin

That’s because profit margins vary from industry to industry, which means that companies in different sectors aren’t necessarily comparable. So, for example, a retail company’s profit margins shouldn’t be compared to those of an oil and gas company. By dividing operating profit by revenue, this mid-level profitability margin reflects the percentage of each dollar that remains after payment for all expenses necessary to keep the business running. Items included in operating expenses are rent, salaries/wages for employees outside of production, business travel costs, property taxes, and research & development costs. If you are confused about how to go about this, you can calculate your commissions on an automation platform or sales compensation calculator. Having full visibility of your commissions is a great way to boost your earnings.

Commission Calculator

Commissions may have the power to incentivize reps to stick with your company long-term. Certainly, some types of commission structures are more attractive than others and can give your company an advantage when attracting and retaining the best sellers. Leese believes the best commission plans align the salesperson’s interests with the company’s interests. When you choose the excess above margin target, the commission will be computed on the sales exceeding the threshold (quota) adjusted for a given margin. For example, if the operation margin (or sales margin) of 58% with a margin target of 50% results in a $2,000 excess in gross sales, the commission with 10% rate would provide $200 commission. It is crucial to choose and design an adequate sales compensation plan according to your business type.

How to Calculate Sales Commission Formula

Because expenses that make up COGS, such as direct materials and direct labor, are inevitable expenses, investors consider gross profit a measure of a company’s overall ability to generate profit. Give your RevOps, finance, and sales teams transparency into sales compensation. Therefore, each salesperson would earn $1,920 in commission from the $62,000 in total sales. This type of commission pay is especially useful when there is no consistent source of income.

What is net profit & how to calculate it using the net profit formula

Reps, the last thing you’d want after spending the entire quarter closing deals is an incorrect commission payout. To avoid inaccurate compensation, it is important to have a good understanding of your sales commission structure and how to calculate sales commissions. Revenue commission plans are beneficial for smaller sales teams which deal with homogenous product or service with fixed prices. A successful commission structure is a win-win for your company and your sales team. While lucrative commission schemes help attract and retain reps who are motivated by earning potential, a commission structure that motivates everyone on your team is best for business. Strive to create a program that drives performance, boosts your profits, and builds a strong sales force as a result.

- Advance against future earnings, creating financial stability but requiring repayment through sales.

- Below is a selection of the sales commissions I’ve encountered in my career that you could choose from.

- When you buy in bulk, you pay less on average per item, which further decreases expenses and increases the profit made on each sale.

- No matter what type of business you run, taking more time costs more money.

- Pay attention to the price, and buy in bulk when prices are low or supplies are on sale.

In the example above, it is representative of a big company, and it is multistep. The income statement (end of June 2020) for business ABC shows a sale of $60,000. They also sold an old van for $3000 while spending $2000 on settling a lawsuit. Other limitations include the possibility of misinterpreting the profit margin ratio and cash flow figures. A low net profit margin does not always indicate a poorly performing company. Also, a high net profit margin does not necessarily translate to high cash flows.

Do you own a business?

This encourages reps to over-perform as the amount they expect to earn increases, thanks to the higher percentage. Draws must be included in a rep’s commission plan, as it serves as a guarantee of cash flow on days when the rep is not able to meet quotas or close deals. It is a predetermined amount which imitates the functions of a loan or an advance which the rep needs to or need not pay back, based on the compensation plan. Draws are common for when the rep is a new joinee or during times of uncertainty. A commission plan with accelerators, bonuses, and spiffs can motivate positive selling behaviors but only if you can see how close you are to reaching key milestones and thresholds.

Improving net profit margin

Tiered commission works great to motivate reps to surpass set sales quotas. If a rep has attained their sales quota, they might not be driven to close more deals as they won’t get paid anymore. how to calculate commission on net profit So, to make sure they continue to close deals, you could add a higher commission rate after the 100% threshold. If your product costs $100,000, and you incur a cost of $10,000 for that sale.

- This starts at a high level by determining the commissionable income for each sales rep. Most often, this will be the total revenue generated from their sales minus any adjustments.

- To see why sales commission is an effective way to compensate salespeople and boost sales of the product or service, let’s see what may happen without such sales motivational quotes.

- Selling, general, and administrative (SG&A) expenses are also included in the operating expenses of a business.

- Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

- Also, commission income earned is still subject to taxes withheld.

How are my competitors compensating their sales team?

This sales commission structure can guarantee bottom-line profitability while motivating employees. There is not really any standard commission rate for independent sales representatives since commissions vary depending on what is required. Commissions for independent sales representatives can vary from as low as 5% to as high as 40%. In addition to the level of effort required to sell your products. In a tiered commission structure, the commission rate increases as the salesperson reaches higher sales targets. To calculate the commission, you need to determine which tier the total sales fall into and then apply the corresponding commission rate.

Remove unprofitable goods and services

To determine the total revenue, multiply the number of goods sold by the price of the goods. Total revenue refers to the total amount of sales earned during the accounting period. The net profit figure comprehensively displays the profitability of a business, and it is used in publicly traded companies to calculate their earnings per share (EPS). Now that you have the compensation structure in place, it is time to focus on the process that will act as a determinant for the commission calculator. This commission calculator is useful when multiple performance measures are included in the incentive plan.