What is Martingale inside Forex? Learning how to make use of the Martingale method

Content

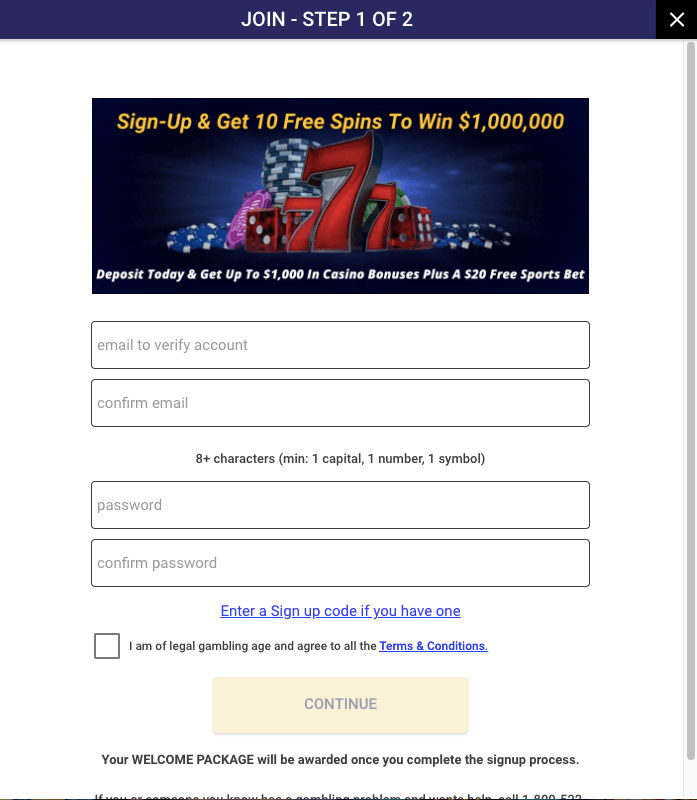

It even started to be minimal in the gambling enterprises since the people finished upwards losing a lot more than they anticipated to winnings. Trade financial products carries a top risk to your investment, especially if entering leveraged deals such as CFDs. You will need to note that anywhere between 74-89% of shopping buyers generate losses when trade CFDs. These products may not be right for individuals, and is crucial that you totally comprehend the threats involved.

Using the Martingale method, it double the bet to $cuatro to the second bet. Thus, on the Martingale trade approach, just after dropping, you will want to double their exchange and you can hope that you’ll win. To use the brand new martingale method effortlessly, investors have to have a huge balance and be prepared to withstand tall drawdowns.

- In theory, the theory should be to twice upon your own stock funding all the day it is down inside well worth.

- Margin is a vow you to brokers receive of traders depending on the size of the fresh membership.

- Low productivity indicate that the fresh exchange proportions must be dramatically larger than funding to possess bring attention as its successful.

- By using reputation measurements, buyers can aid in reducing the risk and avoid bringing too large out of the right position.

Monetary Analyst Degree

All-content on this site is for educational intentions simply and you can does not constitute monetary suggestions. Consult associated economic pros on your own nation of residence to get personalized advice before making any exchange otherwise using conclusion. DayTrading.com could possibly get discovered compensation in the labels or characteristics said on the this amazing site.

Simultaneously, sets for instance the Australian money to the You dollar and you may The newest Zealand to the All of us money exhibit 1st popular services. This happens to own manner long-term more ten months, for each and every everyday candle is closed-in the same assistance. And, your shouldn’t wait for a sharp modification immediately after for example a motion.

The newest Martingale approach may be used in combination with other trading procedures, such as trend following the or breakout actions. Yet not, you will need to very carefully think about the risks and rehearse correct exposure management processes when consolidating tips. The strategy is even heavily centered to your that have a large account balance to endure the fresh growing reputation types, which is not fundamental for the majority of people. Pepperstone will bring various chance administration devices such as avoid-losses requests and negative balance security.

What is the Martingale Strategy? An introduction to the most popular Betting System

It will help manage a normal mrbetlogin.com hop over to this site strategy and you can prevents the techniques out of rising spinning out of control. Mentioned are some examples of your own trade tips made use of on the forex. Investors often merge several steps or modify these to match its exchange design and you may exposure threshold. An important is to get a technique one aligns with your requirements and you may personality because the a trader. The fresh Martingale method is a popular approach utilized in the fresh international change (Forex) or stock market. Exactly why the newest Martingale method is popular within the forex trading is because unlike brings, currencies rarely miss so you can no.

Larry Connors’ RSI twenty-five & RSI 75 (They Nonetheless Works) Trade Procedures Analysis

Even with this type of disadvantages, there are ways to help the martingale means that will raise your chances of succeeding. To arrive this one winnings, an investor do probably become risking a countless amount of money. When you have adequate money to lose you can rating you to definitely 100%.

Like most gambling system, the new Martingale Strategy has its great amount away from benefits and drawbacks. Knowledge these types of pros and cons is important in the determining whether or not so it approach aligns together with your gambling wants and exposure endurance. Probability is a fundamental style in the world of gambling, as well as the Martingale Method capitalizes about this perception. By the looking at the possibilities of particular effects, bettors is regulate how far so you can bet in the for each and every bullet.

It is essential to possess traders to closely consider the problems and benefits of employing this tactic before making a decision whether or not to employ it in their own personal paying or exchange issues. Created in the brand new 18th millennium from the Paul Pierre Levy, a French mathematician, the new martingale system prioritized recouping a loss instead of to make a highest margin of profit. The computer is dependant on the idea of opportunities, convinced that after a few losings, truth be told there need to certainly getting a winnings. Overall, this process makes you increase payouts during the memories and you may reduce losings when fortune is not in your favor. To own simplicity, let’s come back to the new example we took for the Martingale strategy. It risk 2% of your own harmony for each and every trade, and in case it earn, it help the commission, however if it fall, it slice it.

At the same time, the chance is actually decreased while in the bad criteria as the change volume doesn’t boost when the market value falls. Of many exchange steps and possibilities within the Fx and you can Futures segments depend on some type of the Anti-Martingale approach. Frankly that lots of swing change and you may development pursuing the models tend to be somewhat traditional inside their condition proportions allocation when the program might have been sense some loss. If subsequent deals in addition to trigger losses, the new investment try twofold over and over until a winning trade is achieved. The concept about that is that eventual winning change often not merely defense the earlier losses and also build an income.

In this case, the fresh trader you are going to decide on the newest Martingale program to boost their chances of making a profit. Because of this if the very first change is not profitable, the new trader tend to purchase $20 in the next exchange (doubling its funding in the earlier trading). If the next change is additionally unsuccessful, the fresh individual usually purchase $40 in the next trade, and the like. While it is going to be great at particular circumstances, they sells a top danger of higher loss. As well, the potency of the strategy decrease with every successive dropping choice because it becomes increasingly unrealistic that you’re going to recoup your losses to make money since you look a deeper opening.

What’s Martingale Condition Sizing?

A fast Search can show that the binary alternatives Martingale strategy is not the only organize truth be told there. I checklist a few of the greatest choices lower than to choose which is best for your own champ’s trading plan to see how they differ. The brand new places might be unpredictable, thus being ready to accept the brand new intrinsic threats doing work in exchange try very important, even after the fresh Martingale means and you will candlestick development study. When you’re sharing the new Martingale means, it often impacts the fresh buyer’s mind whether it’s like the fresh twice-up method. However,, prior to i break you to definitely belief, it must be less than all of our invited that they each other share certain similarities. The newest Martingale means uses this idea because it assumes one rate peak one deviates from the long-identity development will eventually return.

The forex market comes to risky, plus the Martingale means can result in significant losings should your trader experience a series of shedding deals. Which have a fx Martingale trading means, you basically lower your average admission rate each time you double the choice. Investors can be exit the forex market after increasing the ranks and you can reducing the mediocre price of currency pairs, thereby taking advantage of the elevated exchange rates. As an alternative, they could choose stay-in the market industry expanded, as opposed to next increasing their ranks, in order to probably get to highest earnings while the market increases.

As well, the fresh Martingale method is fundamentally based on the expectation that likelihood of achievement inside a trade are fifty%, that isn’t constantly the way it is on the foreign exchange market. Although not, the fresh Martingale strategy is extremely high-risk and will cause high losses otherwise made use of meticulously. To attenuate these types of risks, a customized Martingale approach you will involve using another way for figuring how much cash which is committed to for each and every change. Thus, in case your individual wagers adequate they’s most likely he’s going to eventually wade chest. Although this means will likely be great at some cases, it is quite very risky and will cause significant loss otherwise used carefully. The strategy is actually a negative evolution program that requires increasing your stake after every loss, in an attempt to recoup losses and you will break-even.